In an exclusive three-part series, Telecom Review will share valuable insights on benchmarking the performance of Top Global Telcos in Q1 2023. The first installment will deal with CAPEX performance.

In Q1 2023, the top 19 global telcos covered in this analysis experienced a modest growth rate of 3.3% YoY, reflecting their resilience and adaptability in the dynamic telecom industry.

Bharti Airtel and Reliance Jio, the leading telcos in India, achieved substantial YoY growth rates of 14% and 12%, respectively, showcasing their consistent positive trajectory. However, these growth rates were slightly lower compared to previous quarters.

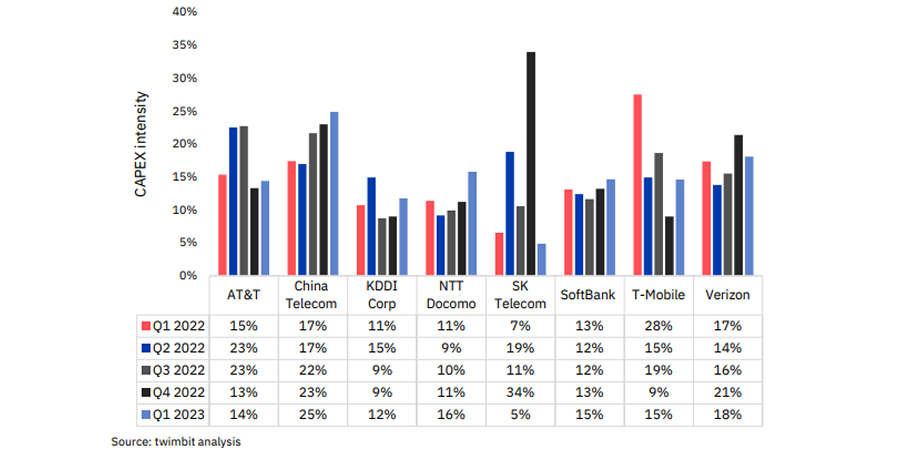

With 5G penetration reaching its peak in certain regions in 2022, it is not surprising that CAPEX spending for telcos declined by 130 basis points to 16.7% in Q1 2023, which reflects the industry’s focus on optimizing investments in line with market needs.

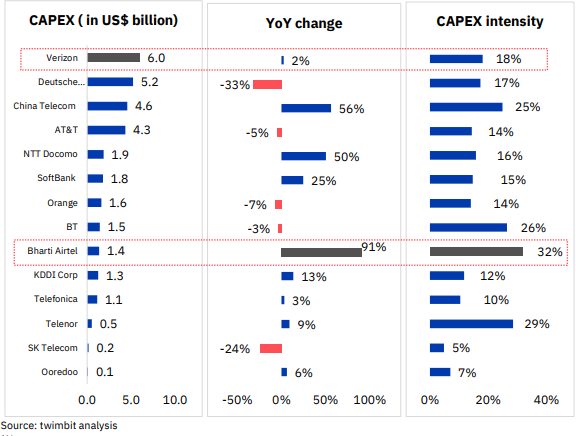

CAPEX performance, Q1 2023

Despite the overall decline in CAPEX spending, several telcos demonstrated remarkable growth in this area. Bharti Airtel, China Telecom and NTT Docomo were among the leaders, with each of their CAPEX increasing by more than 50% YoY.

Bharti Airtel achieved an impressive 91% increase in CAPEX globally, primarily driven by their aggressive 5G deployments in India. In fact, their operations in India witnessed a remarkable CAPEX growth of 110%.

China Telecom directed a significant portion of its CAPEX — which grew by 56% to US$4.6 billion — to industrial digitalization initiatives. The company has ambitious plans to further increase its spending by 40% in 2023.

On the other hand, Deutsche Telekom and SK Telecom were major telcos that witnessed CAPEX declines in Q1 2023.