In this exclusive three-part series, Telecom Review continues to share a comprehensive evaluation of the Q2 2023 performance of prominent global telecom vendors, including Cisco, Ericsson, Nokia and ZTE.

In this second installment, we look at the vendors’ strong focus on R&D, which remains critical for these companies, enabling them to sustain innovation and uphold their competitive advantage.

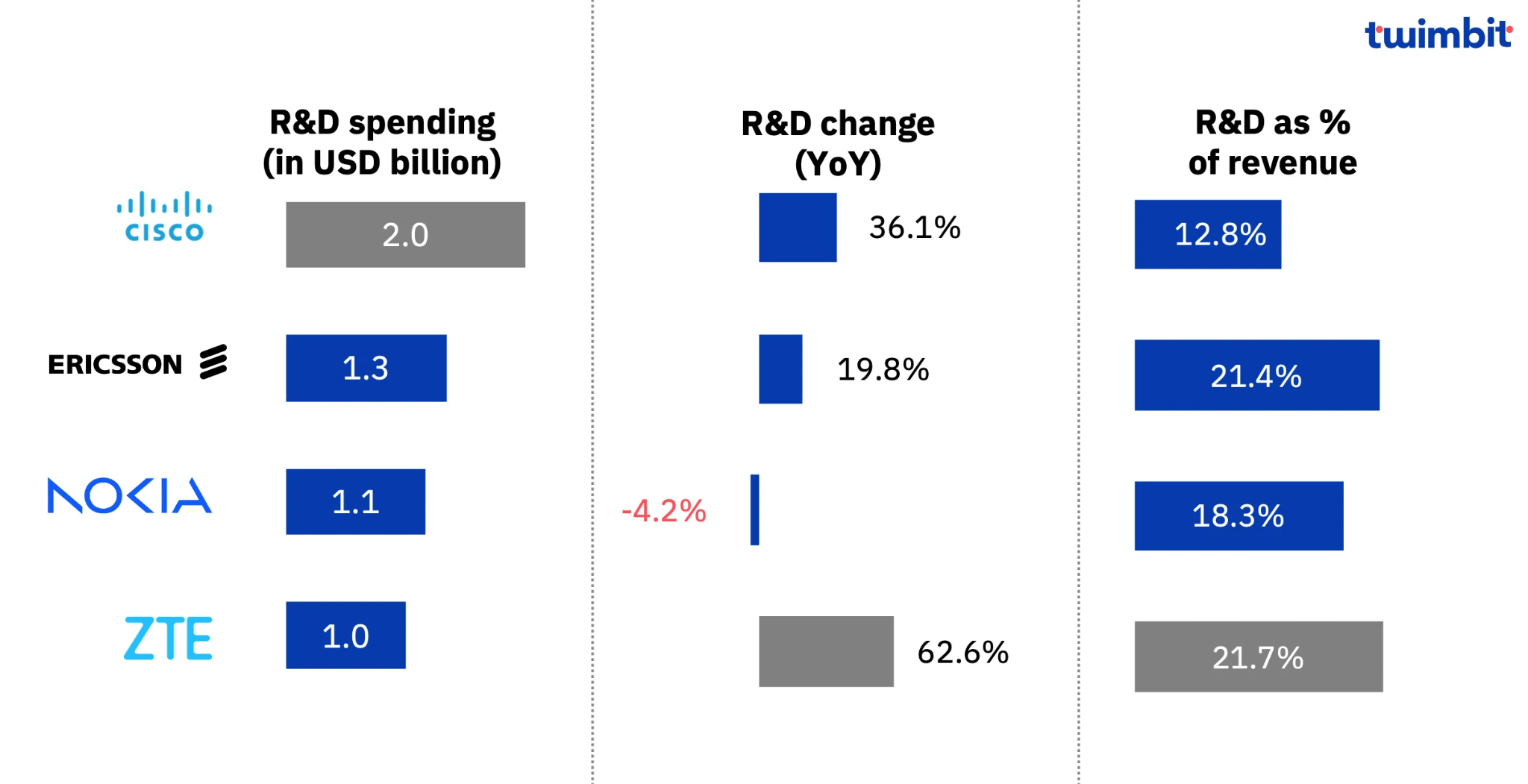

In overview, ZTE demonstrated a remarkable 62.6% increase in R&D spending, while Cisco witnessed a significant 36.1% YoY increase. Both Ericsson and ZTE allocated over 20% of their revenue to R&D endeavors.

Source: Company Reports and Filings, Twimbit Analysis

Cisco

Cisco witnessed a significant 36.1% YoY increase in its R&D spending, reaching an impressive US$2 billion during Q2 2023. This expansion was fueled by the company’s strategic choice to increase its investment in ICT R&D internationally at its second-largest R&D center in India. R&D spending as a share of total revenue increased by 190 basis points to 12.8%.

Ericsson

Ericsson’s Q2 2023 saw a significant uptick of 19.8% in R&D spending. Notably, this growth was primarily driven by strategic initiatives in the enterprise segment, effectively offsetting the decline in R&D expenses for networks and other segments. Ericsson’s heightened R&D spending within the enterprise segments stems from pivotal moves such as the Vonage acquisition, aimed at expanding their portfolio of enterprise wireless solutions. Consequently, R&D spending as a proportion of the total revenue witnessed a substantial increase of 300 basis points, accounting for 21.4% of the total revenue.

Nokia

Nokia reported a 4.2% YoY decline in its R&D expenses. Despite this decrease, the impact on the allocation of R&D spending as a proportion of revenue was relatively modest, accounting for 18.3% of total revenue. Notably, this decline can be largely attributed to the strategic restructuring undertaken within specific segments during Q1 2023.

ZTE

ZTE continued to expand innovative services in the second curve during Q2 2023, with computing power infrastructure products driving progress. R&D investment increased by 62.6% YoY, amounting to US$1 billion, accounting for 21.7% of its revenue. ZTE has substantially enhanced its competitiveness across all its business sectors by reinforcing the capabilities of data, information and communications technology (DICT) infrastructure products and solutions.

Also Read: Telecom Vendors in Q1 ’23: Focus on Innovation With Increased R&D Spending

Also Read: A Blend of Progress and Challenge: Global Telecom Vendors’ Q3 Financial Performance